Starting as a delivery driver, there’s actually no note on DoorDash, specifically, that talks about the need to have special insurance. For most of us, we were only able to find out what were putting ourselves into, after getting into an issue.

So how do you go about doing this?

In this article, we’ll take a look at whether commercial insurance is needed for DoorDash drivers, the possibility and risk of bypassing insurance on the platform, and what exactly you need to know about DoorDash insurance.

Understanding How DoorDash Insurance Works

So yes, to begin with, Doordash has an auto insurance policy for drivers on its network.

However, with every insurance, come some conditions you need to be aware of.

Firstly, it’s a commercial auto insurance policy that provides coverage to Dashers while they are actively delivering an order. Hence, it only kicks in if you’re involved in an accident “during” delivery and your personal insurance don’t cover it.

Just as most insurance, DoorDash demands that you’re a liable party for the damages or injuries to another party when an accident occurs and your personal auto policy has denied the claim with an official coverage denial letter.

However, any damages to the driver’s car are not covered.

The insurance also has a limit of $1,000,000 for third-party property damage and/or bodily injury, with a $2500 deductible.

Actually, DoorDash insurance should only be a backup plan for people who were negligent enough and eventually got into an accident while delivering.

It works more like the employee insurance you get in most traditional companies. They’re important and useful but doesn’t mean you should wholly rely on them.

Let’s talk about this properly in the next section.

Do You Need Commercial Insurance for DoorDash?

Simply put, yes, you need a commercial insurance policy dedicated to your stay with the platform, even though DoorDash doesn’t necessarily care about drivers’ insurance.

It may not be explicitly commercial (which always works), but any insurance policy (perhaps, an addon) that includes coverage for food delivery or rideshare.

And the reasons are simple:

Many personal auto insurance policies contain clauses that exclude coverage for commercial activities, like delivering food for DoorDash.

If something were to happen during a delivery, your personal insurance company would deny your claim on the grounds that you were using your vehicle for business purposes, not personal.

And this is where commercial auto insurance comes into play. Unfortunately, DoorDash’s own is not the most reliable.

Firstly, it requires you to be currently active, making deliveries. Hence, in a situation where an accident occurs while you’re waiting for orders and not currently delivering, your insurance coverage would be primary.

Secondly, a deductible of $2500 would likely cover most accidents you can get. And if not, DoorDash’s contribution to the incident would be negligible. Also, keep in mind that it doesn’t cover your car.

We’ve also heard from people about how unreliable the insurance is…

And not just this comment alone, as a driver myself I’ve had people complain about similar issues.

Now how do you go around this?

There are typically a number of credible insurance companies that offer commercial insurance. However, we always recommend going with dedicated commercial insurance for food delivery is best. Not only is it cheaper, but also more reliable.

In a recent article, we made a list of our 3 best insurance providers for Doordash.

And If you don’t do DoorDash full time we recommend State Farm, which covers food delivery on every standard auto policy, as long as your delivery time only accounts for less than 50% of your total use by mileage.

However, be sure to confirm this is applicable in your location.

Lastly, DoorDash insurance isn’t all bad, especially with their health insurance products. If you’re able to get any one of them, that won’t be bad.

They could still be used as a backup plan since they don’t cost money.

Can you Bypass Paying Insurance?

To be honest, there are countless drivers that do this.

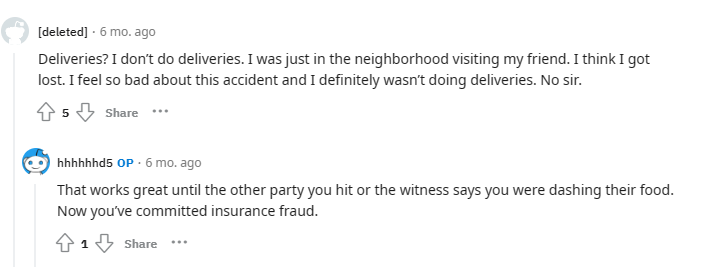

And the idea is simple: people or insurance officers can’t tell what exactly you have or do with your car. Hence, you can mostly lie to get away with it and have your personal auto insurance cover you.

However, ignorant to most people, this comes with a big risk of insurance fraud — which depending on your location and what exactly happened can get you a huge fine if caught.

Now what’s the possibility of getting caught, you ask?

There are many.

Take, for instance, an incident that happens immediately after delivery. While you may have already made mentioned that you’re not a delivery driver, imagine if the customer comes up, defending you that you just delivered to her. Busted.

This is also applicable if you let the victim of an accident know you’re a delivery driver. What if they have the police officer know you’re a delivery driver, while you tell the officer something else? Busted, again.

So while it works, be aware of the risk you may be putting yourself into.

Final Thoughts

It can be stressful to make the cut of extra insurance out of your current revenue. However, if it’s worth it, why not? It’s better safe than sorry.

As an Amazon Associate, I earn a small commission from qualifying purchases. Learn more about this.